Trust & Estate Planning

The trust and estate planning practice at Hemenway & Barnes stands as a strength of the firm, as it has since the firm’s early days.

Estate planning is a personal process and involves the disposition of one’s assets both during life and at death, typically among one’s spouse, children, and grandchildren and often future generations and charities. It is also an on-going process, that evolves as the client accumulates wealth and as their family grows and matures.

As a result, the estate planner at Hemenway & Barnes is likely to develop a long-term relationship with their clients and their families. Our lawyers often serve as trustees and executors, serving as fiduciaries for generations of family members.

Each client's situation is unique and requires a thoughtful, non-formulaic approach to achieve their goals in a tax-advantaged way. This may involve advising an individual on how to move wealth to the next generation in a sound, tax-wise way, counseling a family on how to keep a business or vacation home in the family as a source of unity and shared purpose or working through the difficult days of a guardianship of an older client.

Whatever the situation calls for – fluency in sophisticated estate planning, handling matters discretely in the probate courts or taking full advantage of modern trust planning techniques – all are essential elements of what we do at Hemenway & Barnes.

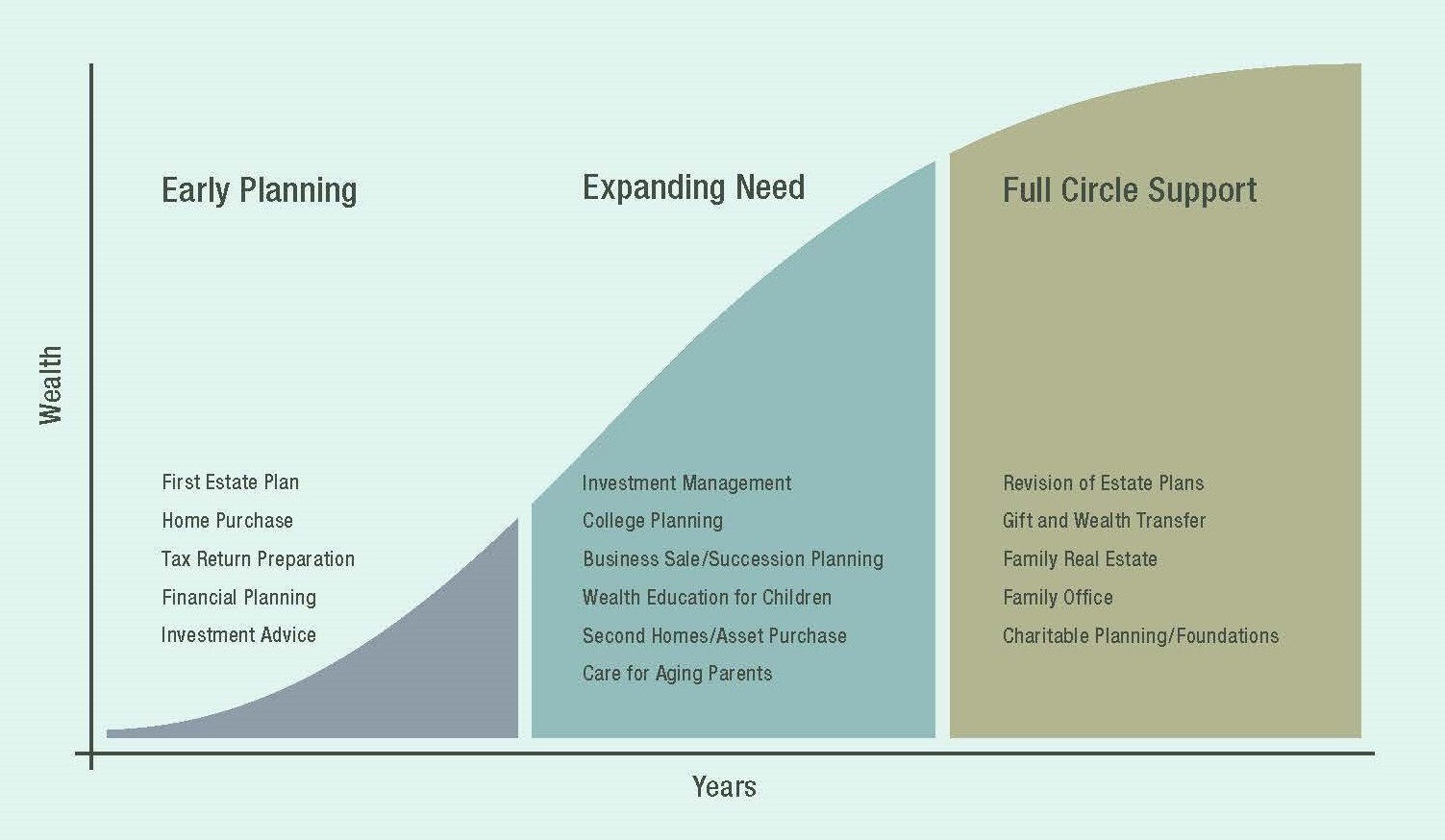

Supporting You as Your Needs Change

We take an integrated approach to estate and tax planning based on your financial situation, family, goals, values, risk tolerance and more. No matter what your net worth or financial situation, it’s important to have a plan in place - and to review your plan as your needs and priorities change.

Joan Garrity Flynn and Joseph Bierwirth to Present at "What is Probate and How to Avoid Disputes" Webinar

Probate can be a complex and often misunderstood part of the estate planning process. Whether you’re organizing your own affairs or managing a loved one’s estate, understanding the fundamentals of probate is essential. This is a must-attend event for individuals looking to better understand probate and reduce the burden on their families.